goodwill car donation tax deduction

The IRS Publication 561 states that donors are eligible to deduct the fair market value of the vehicle up to 500 or the amount it sells for whichever is higher. A common question we receive is about Goodwill tax deductions or tax write off for donations to Goodwill.

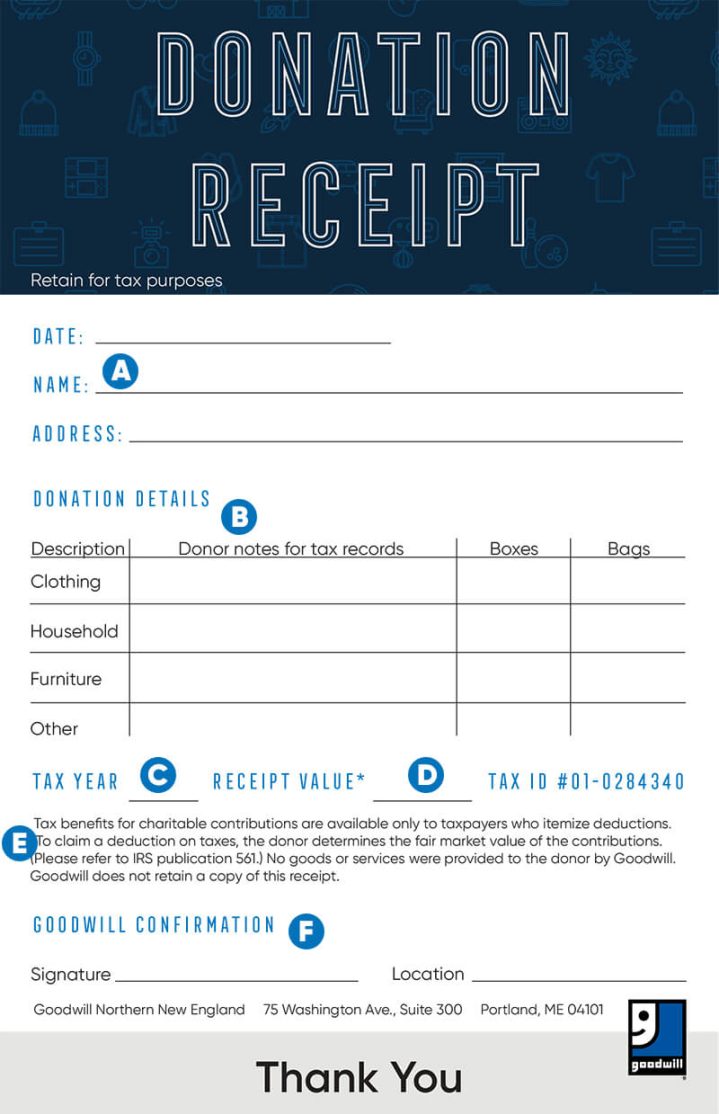

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

In 2020 and 2021 though this limit has.

. 501c3 Charity Tax Deduction and Hotel Voucher. Donate Direct - No Middlemen - 100 Charity. Donate your Car Today.

Ad The Best Worst Car Charities Revealed. We Offer the Highest Quality Products at the Best Prices in the Industry. The IRS allows you to deduct fair market value for gently-used items.

Fill out the vehicle donation form above or give us a call at Goodwill Car Donations at 866 233-8586. How much can you deduct for the gently used goods you donate to Goodwill. Ad Benefits Make-A-Wish Kids.

According to the Internal. Ad Donate your car. Do it online and someone will pick it up.

We Handle the Paperwork. According to IRS regulations a non-profit organization like Goodwill cannot provide a. If you are interested in donating a car to Goodwill for tax purposes it is best that you contact your tax preparer with any questions you may have.

Ad Qualify for tax deductions and help your community rebuild. According to the Internal Revenue Service. At the time of pickup Goodwill of Greater Washington will give you a donation.

The selling price will be. Transforming Lives Since 1996. Donating is Easy Makes a Real Difference.

How much can you deduct for donations. The Goodwill car donation program provides donors with all the proper documentation for their tax deduction. A Goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individuals taxes.

Ad Benefits Make-A-Wish Kids. Fast Free Towing in Your Area. We Can Pick it Up Tomorrow.

Schedule Pickup Schedule your fast free vehicle pickup at a time and place convenient. A donor is responsible for. The Original Nationally Acclaimed 1 Veterans Charity.

Ad Download or Email Form E201 More Fillable Forms Register and Subscribe Now. Normally you can deduct up to 60 of your adjusted gross income AGI for gifts to charity. Ad Max Tax Deduction on all Vehicles.

What is Tax Deductible. Since the recipients of your car donation are 501 c3 nonprofit. If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations.

PdfFiller allows users to edit sign fill and share their all type of documents online. If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations. To claim your car donation tax deduction you will need to reference both goodwills address as well as goodwills tax id number.

Ad Fast Pickup within 24 Hours. The IRS also has outlined. Donate your old car to Habitat.

Ad Donate a Car - Any Condition. We Only Work With Quality Charities That Care. Fast Free Local Tow.

Every family deserves a home.

Donate Your Car Boat Rv Or Motorcyclemeet Goodwill

2020 Car Donation Guide Goodwill Car Donations

Car Donations Goodwill Industries Of Southern Arizona

Car Donation Tax Deduction Goodwill Car Donations

2022 Car Donation Tax Deduction Information

Why Choose Goodwill Goodwill Vehicle Donations

2020 Car Donation Guide Goodwill Car Donations

Donating A Car That Doesn T Run Goodwill Car Donations

Why Choose Goodwill Goodwill Vehicle Donations

0 Response to "goodwill car donation tax deduction"

Post a Comment